In the financial realm, the importance of tax documentation cannot be overstated. As a finance professor with a penchant for the intricacies of tax forms, I find the transition toward the use of a blank 1099-NEC template particularly noteworthy. This transition indicates a significant shift in how freelancers, independent contractors, and similar entities report non-employee compensation. Herein, we will uncover the particulars of the 1099-NEC template, offering insights into its purpose and application and some strategic advice for accurately completing it.

Navigating the Blank 1099-NEC Form in PDF: Purpose and Application

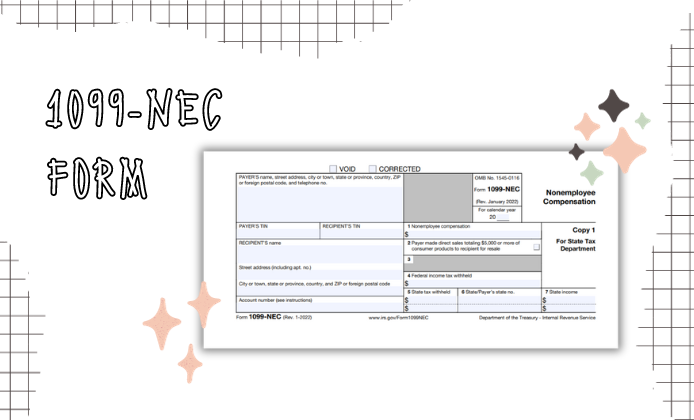

The re-introduction of Form 1099-NEC, which stands for Nonemployee Compensation, marks a pivotal move by the IRS to streamline reporting mechanisms for business payments. This document, specifically designed to report payments exceeding $600 to individuals who aren't employees, serves a critical role in ensuring that freelancers and independent consultants are accurately reporting their income. By providing a blank 1099-NEC form in PDF format, the aim is to offer users a convenient, accessible way to comply with tax regulations, ultimately facilitating a smoother submission process.

Essential Considerations When Filling Out Your 1099-NEC Form

- Accuracy of Information

Ensure all details, especially the taxpayer identification number (TIN) and payment amounts, are correct. - Deadline Adherence

Submitting the form by the IRS deadline is vital to avoid penalties. - State Requirements

Some states have specific filing requirements for the 1099-NEC. Ensure you are compliant with state tax laws. - Digital vs. Print

Decide whether you will submit the form electronically or require a blank 1099-NEC form for print, as the procedures may vary.

Common Pitfalls to Avoid with Your Printable 1099-NEC Blank Form

Errors can creep in when completing tax documentation, resulting in unnecessary headaches and potential financial repercussions. Here’s a brief list of common mistakes to steer clear of:

- Omitting Information

Missing details can lead to processing delays or penalties. - Incorrect Payment Amounts

Reporting inaccurate payment amounts can trigger audits. - Failure to Distribute Forms

Not sending copies to the payee and the IRS on time is a frequent oversight. - Using the Wrong Template

Ensure you’re using the updated printable 1099-NEC blank form, as rules and forms can change.

Whether you are an independent contractor, freelance professional, or someone who manages payments to non-employees, understanding and correctly utilizing the 1099-NEC blank tax form is crucial. With the shift towards digital submissions, having access to a 1099-NEC form in PDF format not only simplifies the process but also ensures compliance with contemporary tax laws. By adhering to the considerations and avoiding the common pitfalls outlined above, you can navigate the complexities of Form 1099-NEC with confidence.

Printable 1099-NEC Form for 2023

Printable 1099-NEC Form for 2023

1099-NEC Blank Tax Form

1099-NEC Blank Tax Form