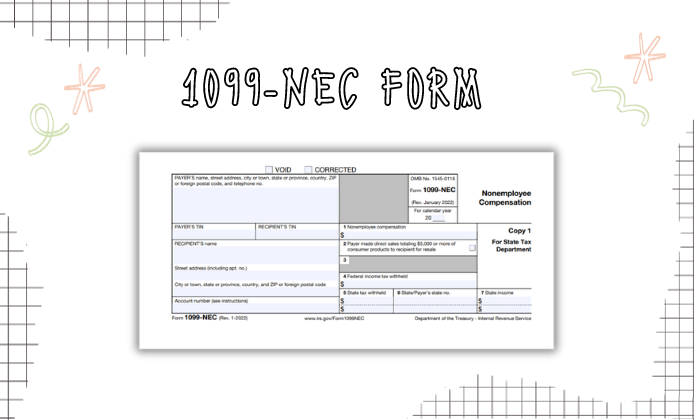

The 1099-NEC form, which stands for Nonemployee Compensation, is a critical document used by the IRS to report any payment exceeding $600 to a nonemployee. This could include payments to freelancers, independent contractors, and other non-traditional employees. The template of this document is meticulously designed to encompass all necessary information, making it easy for both the payer and the payment recipient to understand and complete their tax obligations accurately.

The main fields that need your attention in the IRS 1099-NEC printable form include the following:

- Payer's name, address, and TIN (Taxpayer Identification Number)

- Recipient's name, address, and Social Security Number (SSN) or EIN (Employer Identification Number)

- The total amount of nonemployee compensation paid during the year

- State tax withheld and state/payer's state number (if applicable)

Guidelines for Completing the Blank 1099-NEC Form Correctly

To ensure that the 1099-NEC printable template is filled out accurately, follow these simple instructions:

- Double-check the recipient's information (name, address, SSN/EIN) for accuracy

- Report the exact amount of nonemployee compensation in Box 1

- If state tax was withheld, provide this information in the designated boxes

- Remember to sign and date the form if you are submitting a paper copy

Form 1099-NEC: Step-by-Step Submission Process

Once you have your free 1099-NEC printable form ready, submitting it is the next step. Here's how:

- Collect a completed Form 1099-NEC for each individual for whom you have paid more than $600 during the tax year.

- If submitting by paper, make sure you also fill out Form 1096, which acts as a cover sheet for your 1099s.

- Mail the completed statement to the IRS. Check the IRS website for the correct address, which can vary based on your location.

- Provide a copy of the 1099-NEC to the recipient by the end of January following the tax year of payment.

- If preferred, e-filing is also an option through IRS-approved software, which might be beneficial for those with multiple forms to submit.

Important Deadlines

The submission of the printable 1099-NEC form for 2023 for free has a critical deadline. Both the IRS and the recipient must receive their copies by January 31st of the year following the payment year. This means that for payments made in 2023, the forms must be submitted no later than January 31st, 2024. Delays in submission can result in penalties, making it crucial to adhere to this deadline.

In summary, understanding how to properly fill it out and submit the copy before the due deadline is indispensable for anyone who makes payments to nonemployees. Making use of resources such as a comprehensive 1099-NEC form template can significantly streamline this aspect of tax compliance.

Your Next Step

Ready to take action? Start by downloading the print the 1099-NEC form template available on our website today, ensuring you meet your tax obligations with ease and efficiency.

Printable 1099-NEC Form for 2023

Printable 1099-NEC Form for 2023

1099-NEC Blank Tax Form

1099-NEC Blank Tax Form